Identifying Challenges to Mainstream Cryptocurrency Adoption in Bill Payments

August 27, 2024

The cryptocurrency market has had its fair share of challenges over the past few years. After hitting its highest market cap in November 2021, it’s seen a lot of ups and downs. It's been a bumpy ride for investors, with market slumps and stricter regulations shaking public confidence. The result is that roughly four in 10 adults who have heard about cryptocurrency (39%) say they are not at all confident in its reliability and safety, and an additional 36% are not very confident.1

Cementing this uncertainty are comments from central banks indicating that the integration of cryptocurrencies or stablecoins into mainstream payment systems is currently either insignificant or limited. This sentiment suggests that, despite the growth and awareness of the cryptocurrency market, its adoption for everyday transactions is still far from widespread, reinforcing the idea that significant hurdles remain. If you're uncertain about offering crypto as a payment option, read on to gain a deeper understanding of the complex landscape of cryptocurrency payments and discover the obstacles preventing mainstream acceptance.

Navigating the Paradox of High Familiarity and High Reluctance

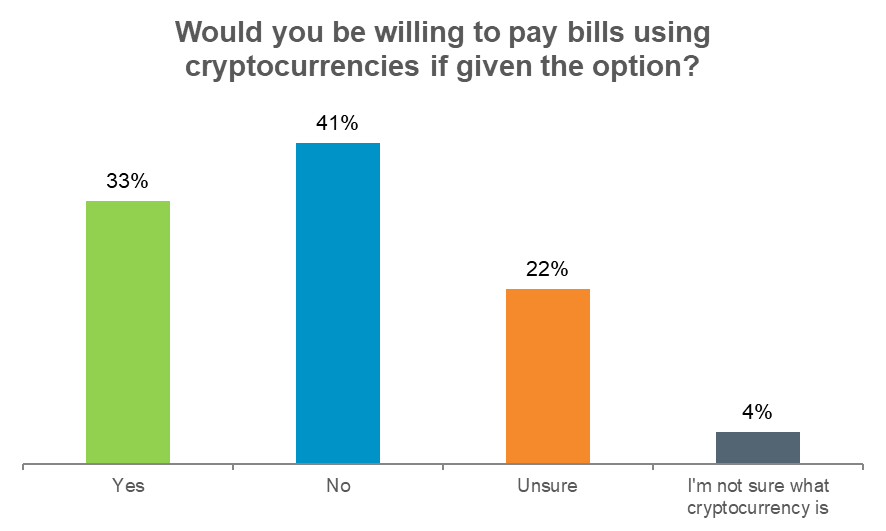

Despite a high awareness of cryptocurrency, the willingness to use it for bill payments remains low. While 81% of adults are familiar with digital currencies, only 33% express readiness to use them, signaling significant reluctance.2 Notably, while there are some consumers expressing interest, 41% outright reject the idea of using cryptocurrencies for bills, with another 22% undecided.3

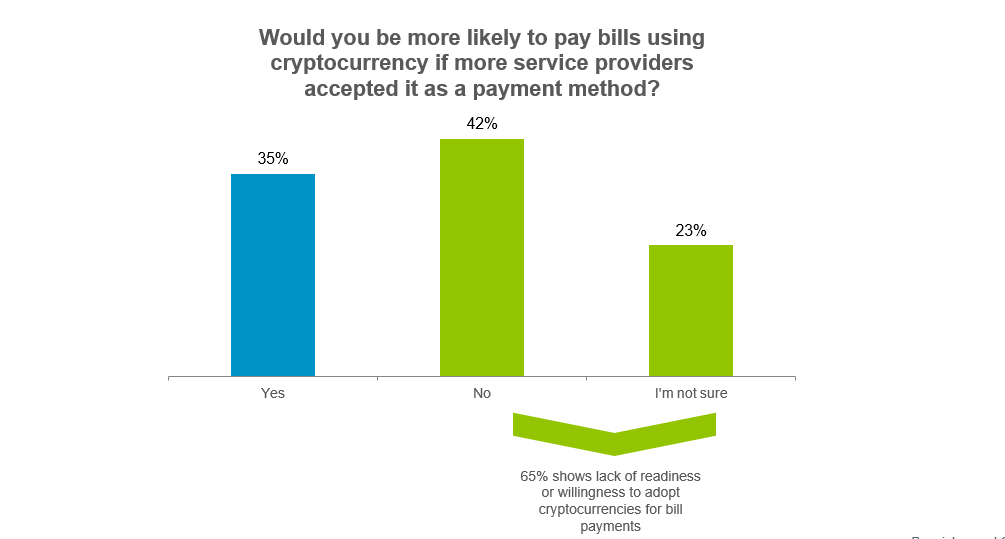

With consumer hesitation so high, it stands to reason that even if more service providers embraced cryptocurrencies, it would not likely result in a significant rise in adoption rates for bill payments. This gap between awareness and adoption underscores concerns about stability, security, and regulatory ambiguity, presenting significant challenges for the mainstream adoption of cryptocurrencies in routine transactions.

Central Banks' Caution on Cryptocurrency Adoption

The fact that central banks aren’t bullish on rapid or widespread cryptocurrency integration into mainstream payment systems should serve as a red flag for billers. Despite the early promising growth and hype, central bankers don’t foresee cryptocurrency being adopted for day-to-day transactions in the near future. Based on a survey from December 2022, their cautious stance emphasizes the need for regulatory clarity and consumer confidence before widespread adoption can occur.

Strategic Considerations for Billers in Adopting Cryptocurrencies

Given the current market uncertainty, adding cryptocurrencies as a payment option may not be a priority for billers now. Though some billers may feel compelled to offer their customers the latest and greatest payment technology, customer interest in using it appears low. Instead, billers should instead focus on enhancing existing payment methods that their customers already trust and are familiar with and adding new ones that customers are interested in. By monitoring market developments and regulatory shifts, billers can adapt their strategies to meet evolving consumer preferences while mitigating risks associated with emerging technologies.

The Long Road to Mainstream Cryptocurrency Adoption

While cryptocurrencies are widely known, integrating them into everyday transactions remains a formidable challenge. Overcoming barriers such as regulatory uncertainty, security concerns, and consumer skepticism will be crucial in unlocking their full potential as a viable payment option. Addressing these issues will require concerted efforts from industry stakeholders and regulators alike. Until then, billers should hold off on making them available to customers.

To learn more about other emerging payment trends, check our research here.

Sources:

- Majority of Americans aren’t confident in the safety and reliability of cryptocurrency, Pew Research Center, 2023.

- KUBRA Emerging Payment Trends Research 2024.

- Ibid.